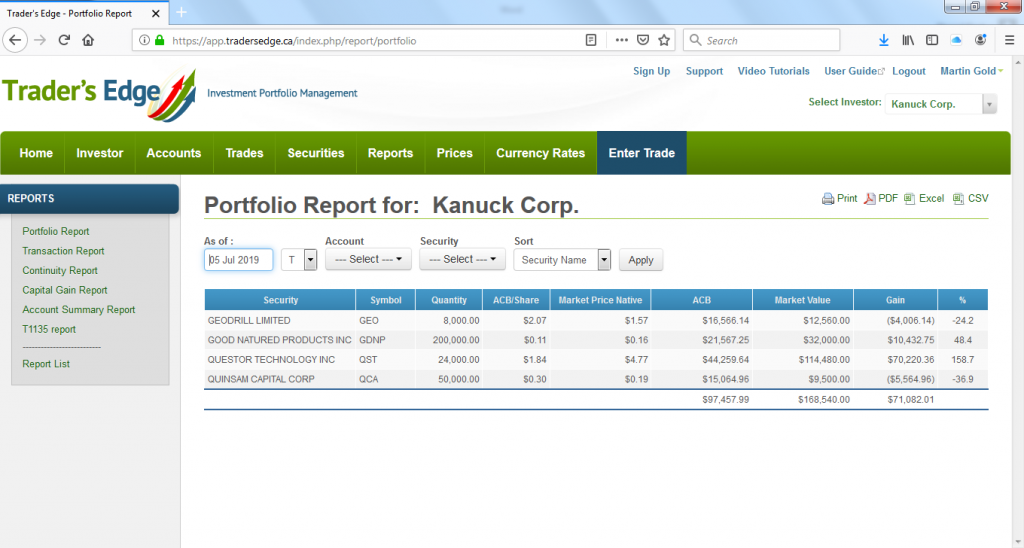

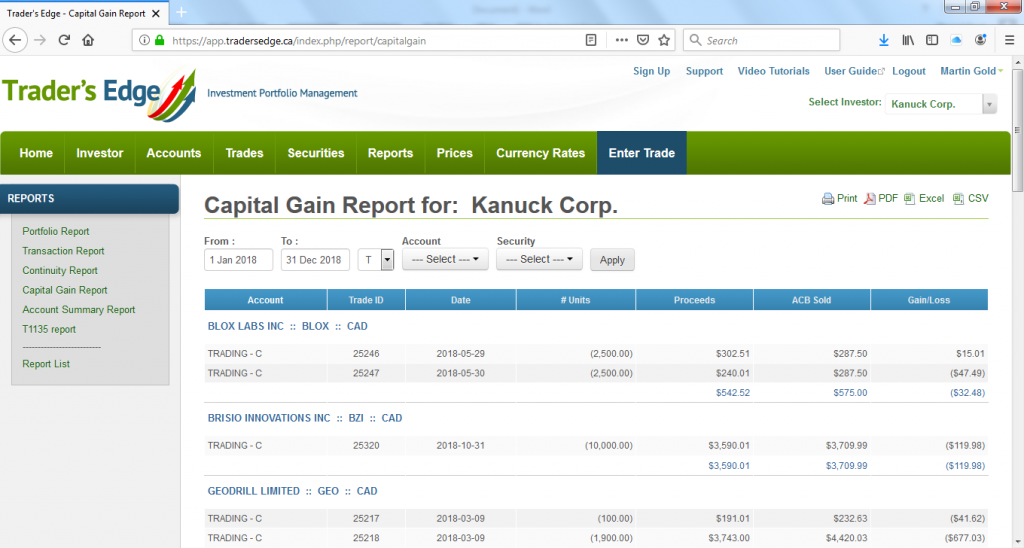

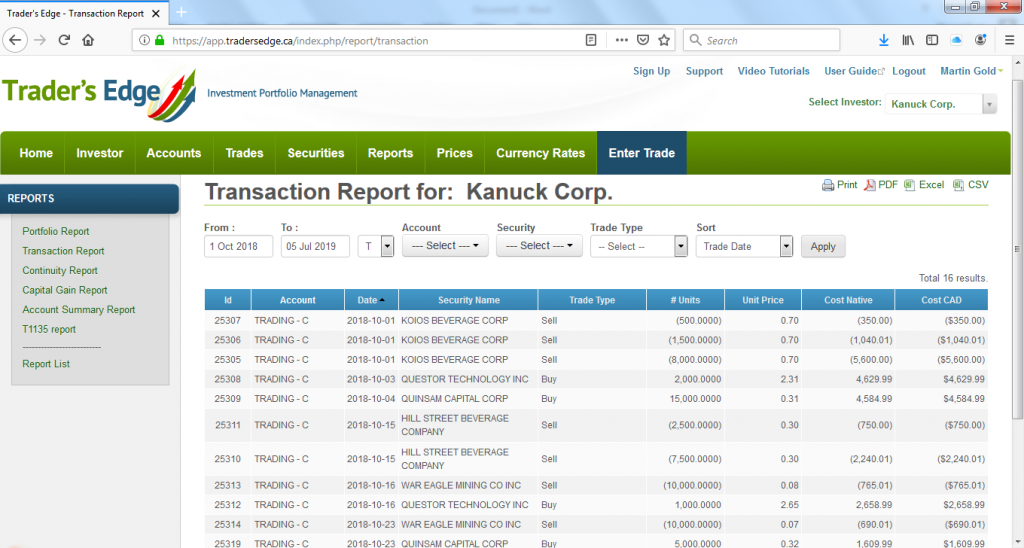

Trader’s Edge is a cloud-based investment accounting and tax platform designed for the Canadian investor market.

With investors owning diverse asset classes such as real estate, stocks, bonds, mutual funds, LPs etc., and increasingly private equity, there is a need to centralize all these holdings and their tax costs. Also, investments held through multiple brokerage accounts results in no consolidation of financial information as broker systems are unconnected. This affects all of the investor stakeholders: the accountant, lawyer, financial and estate planner.

Whether you are an independent investor, a professional CPA accounting firm, small family office or wealth advisor, achieve a holistic view of all your investment assets, essential today for effective investment wealth and estate management.